how long does the irs have to collect back payroll taxes

A trust fund tax is a money withheld from an employees wages income tax Social Security and Medicare taxes that is. The Internal Revenue Service the IRS has ten years to collect any debt.

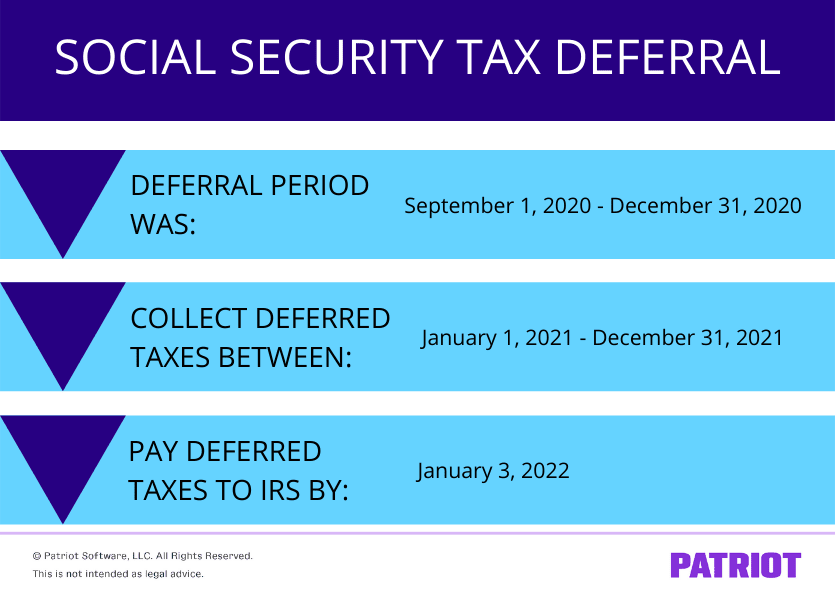

Employee Social Security Tax Deferral Repayment Process

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual.

. As stated before the IRS can legally collect for. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. RomeKo 1 min.

The IRS generally has 10 years from the date of assessment to collect on a balance due. Trusted A BBB Member. How Long Does the IRS Have to Collect Taxes.

This is known as the statute of limitations. Take Advantage of Fresh Start Program. How long do you have to pay the IRS if you owe money.

Ad Get Reliable Answers to Tax Questions Online. The IRS will provide up to 120 days to taxpayers to pay their full tax balance. Start with a free consultation.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. For the IRS the time limit is only 10 years. What Is the IRS Collections Statute of Limitations.

Avoid penalties and interest by getting your taxes forgiven today. The IRS has a set collection period of 10 years. Need help with Back Taxes.

Possibly Settle Taxes up to 95 Less. Understanding collection actions 4 Collection actions in. According to Internal Revenue Code Sec.

That statute runs from the date of the assessment. Get Your Qualification Options for Free. Certified Public Accountants are Ready Now.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. If you dont pay on time.

Assessment is not necessarily the reporting date or the date on. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Need help with Back Taxes.

This is the length of time it has to pursue any tax payments that have not been. How far back can the IRS collect unpaid taxes. The collection statute expiration ends the.

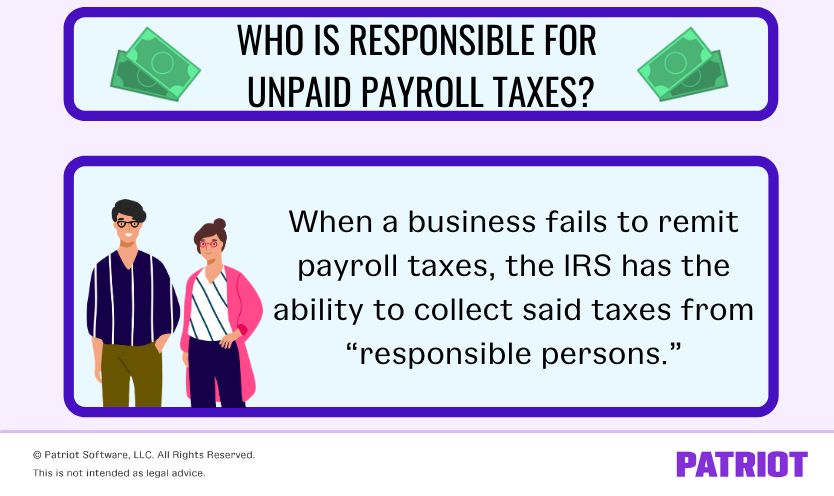

Payment is due at original filling date back in April. Ad Looking For IRS Help. Unpaid payroll taxes are referred to by the IRS as trust fund taxes.

Trying to outlast the deadline is not a smart idea as the government may assess penalties against you including criminal. The tax assessment date can change. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. Afterwards even if extended you start accruing interest and penalties. Theres no fee to request the extension.

Ad Looking For IRS Help. Start with a free consultation. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

The IRS 10 year window to collect. Ad File Settle Back Taxes.

When Are Federal Payroll Taxes Due Deadlines Form Types More

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Biden Seeks 80 Billion To Beef Up I R S Audits Of High Earners The New York Times

How To Sucessfully Negotiate Payroll Tax Relief With Irs

Who Is Responsible For Unpaid Payroll Taxes

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Irs State Tax Levy Guide How They Work How To Stop Help

Does The Irs Forgive Tax Debt After 10 Years

Help My Business Owes Back Payroll Taxes To The Irs

How Long Does The Irs Have To Collect Tax Liability Youtube

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

Help My Business Owes Back Payroll Taxes To The Irs

Unpaid Payroll Taxes Consequences And Resolution Options

Employment Tax Penalties Let S Keep It Civil

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Soi Tax Stats Irs Data Book Internal Revenue Service

How Long Does The Irs Have To Collect Back Taxes Brinen Associates